Established HVAC w/Blue Chip Clients – Semi-Absentee w/Property!

Anaheim, CA

Asking: $1,900,000

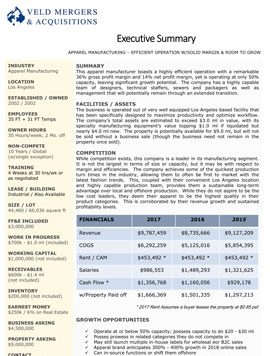

Gross Revenue: $4,489,716

Potential Cash Flow: $561,279

This well-established Anaheim Area heating, ventilation and air conditioning (HVAC) is a market leader in its category of commercial system design and installation for new build and replacement units. Over the past 25+ years, the company has aligned itself with Southern California’s major general contractors that service blue chip clients on majors builds that may include hotels, shopping centers, offices complexes, major retailers and more. The company has staff held C-20 Heat and Air and C-38 Refrigeration contractor’s licenses. It also has a separate layer of seasoned management staff, which should help alleviate common transition issues. The firm regularly completes 100 jobs per year for 30-40 contractors. Job size may vary but the average ticket is in the $100k range. Small retail ground-up engagements may be in the $30k – $50k range, while other jobs may exceed $500k.

Please note that the $900k property will not be sold without the business, though the $1.9 million business may potentially be sold without the property and the owner remaining the landlord. The facility would lease for $4.5k/mo on a long-term lease.

Please note that the $900k property will not be sold without the business, though the $1.9 million business may potentially be sold without the property and the owner remaining the landlord. The facility would lease for $4.5k/mo on a long-term lease.

Inventory: $100,000

Accounts receivable:500,000

Accounts Receivable Included In Asking? No

Facilities

The company currently has $1.4 ml in current jobs, work-in-progress or signed contracts. A buyer will walk into an ongoing pipeline that naturally varies over time. Cash, an estimated $500k in A/R and/or $500k in working capital and/or $1.8 ml. in retention is not included in the sale but can be purchased on a $1:$1 basis. Roughly $100k in inventory will be sold at cost at close.

Competition

This is a competitive industry where historical reputation and crew performance speak volumes and determine a firm’s credibility. As this is a well-established incumbent enterprise with no key crew members anticipated to transition out in a sale, this firm’s goodwill and lengthy top-tier general contractor client list and end user customer base provide it a distinct advantage that an industry entrant or transitioning residential or smaller commercial firm would find difficult to compete against when bidding

Growth & Expansion

The company may experience a tremendous uptick in business as result of COVID19 as schools and businesses upgrades their HVAC systems with high-efficiency particulate absorbing filters and high-efficiency particulate arrestance filters (HEPA). Additional opportunity exists in the residential market, whether in the multi-unit apartment, condominium or the single-family segment of the residential market. Unlike many HVAC companies, the company does not offer a service component that provides a recurring revenue stream. New management will likely wish to develop and implement one of these sought-after service components. The financials reflect an absentee run operation. Should a full-time working owner replace the general manager or should an existing operation’s management team absorb the functions into their existing infrastructure, new management may realize an additional $100k in annual savings.

Support & Training

Seller will train for 4 weeks at 20 hours per week or as negotiated

Reason For Selling: Retirement

Real Estate: Available for $900k. Will not be sold without the business sale, but the business may be sold without the Property.