Skin Care Product Brand w/Excellent Reviews & Reputation

Los Angeles, CA

Asking: $14,000,000

Gross Revenue: $15,000,000

Potential Cash Flow: $3,000,000

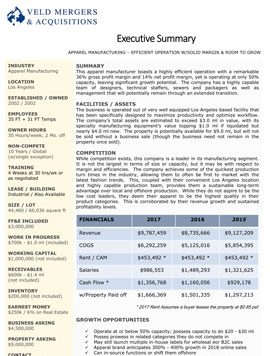

This acclaimed skin care brand is an unparalleled leader in its 3 novel primary sales channels. Together with its direct to consumer sales efforts, the beauty care brand enjoys remarkable market access that allows it get newly launched products in front of customers and into their hands within weeks. The company has generated over $30 ml in average annual top-line revenues (pre-revenue share / commission splits) over the past 3 years, which included 2 transition years. They boast a strong foundation and track record for being able to deliver significantly higher sales volumes, should the buyer wish to replicate its proven formula that resulted in over $50 ml in peak year pre-revenue share / commission split retail sales.

Sellers envision the buyer to be an established Beauty Care firm with the experience and bandwidth to step into the operation, or a new platform or bolt-on for an existing PE firm. This is not a likely match for the Independant Sponsor / Sponsorless Fund or Search community. While a majority buyout is anticipated, a minority investment (i.e. 40% – 50%) may also be considered.

Sellers envision the buyer to be an established Beauty Care firm with the experience and bandwidth to step into the operation, or a new platform or bolt-on for an existing PE firm. This is not a likely match for the Independant Sponsor / Sponsorless Fund or Search community. While a majority buyout is anticipated, a minority investment (i.e. 40% – 50%) may also be considered.

Inventory: $2,600,000

Accounts Receivable Included In Asking? No

Facilities

This 27k square foot facility leases for $47k/month on a secure long-term lease with options. All of the company’s assets, goodwill and key vendor, marketing and sales channel relationships will transfer in the sale.

Competition

While the skin care industry is a highly competitive one, this firm has carved out a unique niche via its formidable product development and go to market strategy that provides them the ability to quickly pivot if desired and to launch products within a matter of days as opposed to weeks and months, creating a long-term competitive advantage.

Growth & Expansion

New operators will hope to capitalize on the enormous recognition and a tremendous following the well-established brand has amassed in its direct-to-consumer sales channels – including its own ecommerce store and Amazon shops that they have only recently emphasized. A buyer’s existing product lines in similar product categories may be rebranded and offered via the same formidable sales channels to the loyal customer base or management may choose to focus on expanding the boutique or big box retail presence, growing web, Amazon & subscription base, etc.

Support & Training

As negotiated through an agreed upon transition period

Reason For Selling: Personal